Tuesday, 7 April 2015

IT Security: "Dyre Wolf" Attacks Target Enterprise Bank Accounts by IBM

A combination of new malware and old-fashioned social engineering has been used to rob companies of more than US$1 million, according to a new study from IBM.

The attacks, dubbed “Dyre Wolf” by IBM, suggests the work of experienced online criminals brazenly attempting to rip off large organizations.

“As we continue to see, cybercriminals grow in resourcefulness and productivity at alarming rates. They are sharing expertise on a global scale via the deep Web and launching carefully planned, long-term attacks to attain the highest return on investment,” wrote John Kuhn, IBM senior threat researcher, in a blog post co-authored with fellow IBM researcher Lance Mueller.

Dyre Wolf uses a variant of Dyre, which is malware written to target the websites of hundreds of banks..

“Since its start in 2014, Dyre has evolved to become simultaneously sophisticated and easy to use, enabling cybercriminals to go for the bigger payout,” Kuhn wrote. An organized but as-of-yet unidentified group of attackers also rely on talking to users by phone, in order to bypass the two-factor authentication most organizations have put in place to thwart online attacks

Since October, IBM has seen a spike in the infection rate of Dyre on corporate networks, spiking from 500 instances to nearly 3,500. It estimates that anywhere from $500,000 to $1.5 million has been lost through Dyre-based attacks

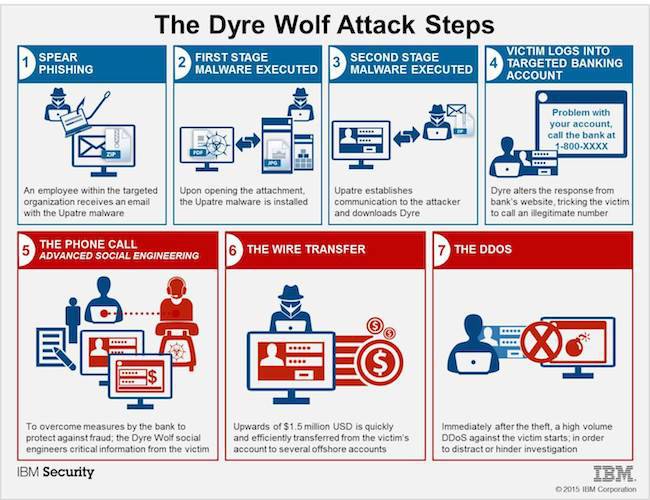

IBM posted a paper outlining in detail how the attack works.

A user is tricked into installing the Dyer software on the machine by the usual means, perhaps by clicking on a malicious email attachment.

The installed program remains silent until a user attempts to log onto a bank website recognized by Dyre. At that point, a Web page will pop up explaining the site is experiencing technical difficulties and that the user should call the help center to gain access.

The attackers are sophisticated enough to rig the software so that when the user calls, the attackers answer the phone posing as a representative from the bank. They then trick the user into giving up the password. By the time the phone call is finished, money is already transferred out of the enterprise’s account and is rapidly moving across different banks around the globe to evade detection.

IBM has estimated that 95 percent of all corporate attacks rely on some form of human error.

Most employees have already been trained not to click on unknown documents received by email, as well as to not give up passwords over the phone. A single inattentive user, however, could result in the loss of large sums of money.

To guard against Dyre Wolf, security professionals should reinforce company best practices that should already be in place. Employees should be reminded that banks never ask for passwords and that they should report any suspicious behavior. An organization may also wish to carry out mock-attacks to ensure that employees are fully trained on how to handle such incidents, Kuhn said.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment